Cum-Ex Trading – Update and Frequently Asked Questions – Series 1

Christoph Spengel, professor of taxation at Mannheim University, told committee members last month “Most experts believe this shortcoming was shut in 2012. This assumption is false.”

A lot has happened since FMCR last published “Were ADRs used for Cum-Ex Trading?” and “Cum-Ex trading – is your firm affected?” – two British traders have been found guilty of tax evasion, more participants have been indicted, new European jurisdictions have launched investigations and the FCA have started investigating the involvement of a number of UK institutions and individuals in Cum-Ex.

FMCR will be putting out a series of simplified explainers to address some of the queries we have been receiving.

What is Cum-Ex?

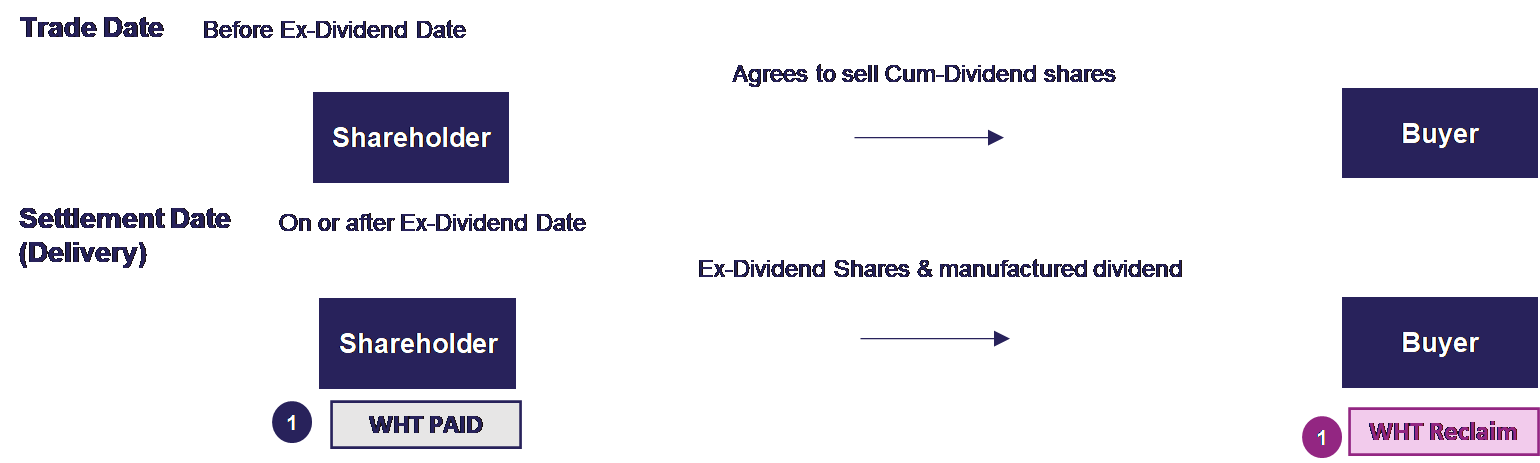

A typical Cum-Ex trade is a trade involving shares which are unsettled over dividend date. On trade date, when the trade is agreed, the shares are trading cum-dividend (with dividend). By the time the shares are delivered on settlement date, the shares are trading ex-dividend (without dividend). The name Cum-Ex is derived from the shares being traded Cum but settled Ex.

Cum-Ex trading has potentially created duplicated withholding tax reclaims which allegedly has lost European tax payers billions of Euros. Various European tax authorities and regulators are investigating.

How does Cum-Ex trading typically work?

To explain this further, it is best to look at two unsettled share trades over dividend date - one which results in duplicated tax reclaims and one which does not.

In this example, there are two WHT reclaims made but only one WHT paid. A short seller who typically borrowed ex-dividend shares from a stock lender to meet delivery requirements could create a situation where the WHT is reclaimed on the same set of shares multiple times. Let’s look at an example without duplicated reclaims.

The Shareholder sells Cum-Dividend shares on trade date but delivers Ex-Dividend shares on settlement date. The Shareholder is not a short seller and therefore owns shares on trade date. The Shareholder receives the dividend and pays withholding tax. As the buyer paid for Cum-Dividend shares but receives Ex-Dividend shares, the Shareholder pays the Buyer a manufactured dividend. The Shareholder has both received (an actual) and paid (a manufactured) dividend, the flows are netted and the Shareholder is not entitled to make a WHT reclaim. The Buyer goes on to make a WHT reclaim on shares where the WHT has been paid.

What factors can create a potential duplication of WHT reclaim?

The examples have been simplified for ease and thus, this list is not at all exhaustive but:

a buyer who purchases from a short seller

a short seller who borrows ex-dividend shares to make delivery on a cum-dividend trade

reusing same shares in settlement cycles

How can you tell if the seller is a short seller?

Cum-Ex transactions were typically traded at levels which did not make economic sense if the seller was a shareholder who had paid withholding tax. However, the effective level at which trades took place was sometimes disguised using additional trades.

What is a short seller?

A short seller is a seller who does not hold shares at the time of trade and sources them (Ex-Dividend shares) for delivery.

Are there other products that could be used in Cum-Ex?

In short – yes! This will be covered in our next instalment.

FMCR is an industry-recognised equity dividend arbitrage expert and is currently undertaking multi-faceted investigations into high profile potentially irregular activities in several European markets.